Opyn released Squeeth in January, which is similar to an option without an expiry date or strike price. Some have suggested that it could be used to hedge Uniswap LPs, hedge all ETH/USD options, and predict the volatility of ETH in the short term. However, it is yet to be seen whether Squeeth will actually serve this purpose.

Experts Predict How High Ethereum’s Price Could Go in 2022

Ethereum is a cryptocurrency that is known by many investors and enthusiasts. It has had a rough first half of the year, but experts predict that it could still get back above $4,000 in 2022.

Since its creation in 2015, the value of Ethereum’s native token, ether (ETH), has grown immensely. Launched by computer programmer Vitalik Buterin, ether reached a high of around $4,800 late last year after increasing in price from $0.311 at its launch. Although there has been plenty of volatility along the way, ether continues to grow in value.

Ethereum’s value fell below $1,300 on Monday morning, but it recovered later that afternoon. Even so, Ethereum has lost about 13% of its value over the last week.

The token reacted to the Fed’s announcement that it would hike rates by 75 basis points, but the impact was short and relatively small. Even though the market already expected that move, Ethereum’s prices are still low, signifying that the economic situation is still tough despite not being surprising.

One way ethereum is different from bitcoin and other cryptocurrencies is that it can be used as a software network to develop new tools, apps, and NFTs. The blockchain-based software network has many uses across the tech world, especially for gaming, music, entertainment, and decentralized finance (DeFi). This makes ethereum one of the most popular and widely-used cryptos this past year.

If you had invested in ether in 2014, your investment would have increased by 400% by now. However, experts say that you should only invest what you can afford to lose, as cryptocurrency prices are very volatile.

Ethereum Price Prediction for 2022: Between $500 and $4,500

According to several experts, ETH could once again break $4,000 in 2022. A recent ethereum price prediction by Bloomberg intelligence analyst Mike McGlone has it ending the year between $4,000-$4,500.

According to the experts we spoke to, predicting the value of Ethereum with any certainty is practically impossible. However, Coinpedia, a crypto news outlet, has predicted that if the market trend from mid-2021 continues, ETH could be worth between $6,500 and $7,500 by the end of 2022. However, the bearish downturn in the market in 2022 shows that Ethereum’s price is not going to just go up because of positive sentiment. Therefore, Coinpedia has revised its prediction for 2022 and believes ETH will be worth $2,500 by the end of the year.

According to crypto market analyst Wendy O, Ether could see a price crash of up to 85% from its all-time high, leading it to a price of around $750. This is based on the possibility of a broader market sell-off. Venture capitalist Kavita Gupta has said that Ether could fall as low as $500 in this scenario.

Some experts believe the price of Ethereum will be more volatile than that of Bitcoin in the near future, due to Ethereum’s transition to a version that requires less energy. Ethereum’s upgrade could make it more appealing and sustainable for widespread use, but until that happens, experts are waiting to see how investors and companies building their tech on Ethereum’s platform respond to the changes.

If investors want to see ether’s price continue rising in the long term, they will need to see improved demand and functionality in the near future. The blockchain is currently facing competition from similar platforms that are filling in its gaps, while the ethereum team is working to transition to its second-generation updates.

Henri Arslanian, global crypto leader of the professional services firm PwC, said in an early 2022 episode of CoinDesk’s First Mover that Ethereum was the only show in town.

PRO TIP

Financial planners suggest only investing a small amount of your money in crypto because the market is very unstable and prices can change quickly.

Ethereum Price Prediction for 2023: Between $2,400 and $5,000

Two major factors that are expected to influence the direction of ether’s price in the next year are the timely rollout of ethereum’s big update in September and evolving investor sentiment on risky assets amid an uncertain economic outlook.

Boyko-Romanovsky expects ETH to reach $5,000 following the upgrade while Coinpedia predicts ETH to start 2023 above $3,000 if the network sees a reduction in congestion and gas fees and further adoption following its massive upgrade. However, if the network struggles to increase adoption following the upgrade or the crypto market remains slumped, ETH could end 2023 at nearly $2,400 according to Coin Price Forecast.

Ethereum Price Prediction for 2025: Between $5,700 and $10,000

Coinpedia is predicting that Ethereum will be worth at least $10,000 by 2025. This is because Ethereum is transitioning to a proof-of-stake system, which will make it more user-friendly and affordable to use. right now, Ethereum’s service fees are very high. However, if this transition is successful, it will allow Ethereum to focus on new projects and developments, which will improve the network.

According to Ian Balina, an investor and the founder of Token Metrics, a crypto research and media company, ethereum has the potential to be worth $8,000. He believes that ethereum is the clear leader in the market, but other blockchains are growing more quickly due to ethereum’s high gas fees and slow transaction speed.

A panel of 53 experts consulted by Finder predicts that ethereum’s price will rise to at least $5,700 by the end of 2025. Meanwhile, the crypto exchange Changelly believes that the price will reach at least $6,000 by the end of 2025.

Ethereum Price Prediction 2030: A $15,000 Upside

One panel predicts that ETH will be worth more than $14,000 by 2030, though another panel is less optimistic about this.

Ben Ritchie, managing director of Digital Capital Management, believes that ETH could reach as high as $15,000 by 2030 because of the upcoming upgrades, lower gas fees, and scalability. He suggests that ethereum’s price is very much linked to the success of the upcoming upgrade and it could possibly outperform bitcoin in the future.

Different Types of Volatility

What is the most accurate metric for measuring volatility?

The volatility of a given stock is the dispersion of that stock’s price. In other words, the volatility of a stock indicates how much the price of the stock fluctuates. A stock with high volatility will fluctuate more in value than a stock with low volatility. In traditional finance, there are several ways to measure the volatility of a given stock.

The most common ways to measure volatility are by using standard deviation or variance. This makes sense as the standard deviation of historical prices of a stock measures the fluctuations and deviations from the average price of the stock: the greater the standard deviation of the prices, the greater the historical prices have moved up or down from the mean. Assuming that the prices of a stock are distributed in a normal distribution, traders can infer that around 68% of all prices of the stock fall within one standard deviation of the mean. Therefore, given the standard deviation as a measure of volatility, traders can make a quantifiable estimate as to the possible region that the price of the stock will be in the future. This type of volatility is called realized volatility.

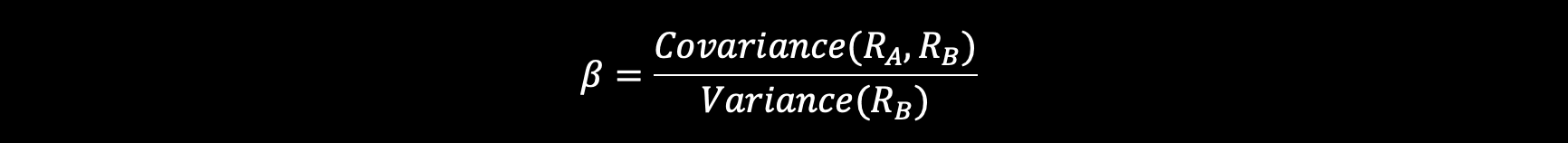

Another way of measuring volatility is to use the beta of a stock. In order to calculate the beta of stock A by comparing to the benchmark stock B, we use the following equation:

A beta of 0.5 means that stock A is half as volatile as stock B. A beta greater than 1 means that stock A is more volatile than stock B. A beta less than 1 means that stock A is less volatile than stock B. A beta of 1 means that the volatility of stock A and stock B are equal.

Options can also give insights into how volatile a stock might be. The price of options can be used to calculate something called implied volatility. Implied volatility does not directly predict the price fluctuations of a stock, but instead estimates the overall sentiment of traders in the options market of how a stock’s price will fluctuate. The implied volatility is usually calculated using the Black Scholes Equation.

We found that Squeeth’s price predictions for ETH were quite good, with a standard deviation of only 2.4%. In our investigation of how well Squeeth predicts ETH’s volatility, we only looked at standard deviation because it is the easiest to interpret. We found that Squeeth’s predictions were quite accurate, with a standard deviation of only 2.4%.

Results

We will be comparing the prices of Squeeth to the past realized volatility of ETH prices to analyze how well prices of Squeeth predict volatility.

The price of Squeeth has increased along with the volatility of ETH, which is to be expected since increased volatility would lead to increased demand for options to hedge ETH. However, the trend line is not linear, it’s polynomial, and therefore the price of Squeeth is tracking ETH^2. There is a lot of variation in the data points analyzed, so the equation cannot be used to determine the current volatility of ETH with absolute certainty.

The standard deviation, or realized volatility, is calculated by taking the sum of the differences of each data point from the mean of the sample. We will also analyze how this difference can be predicted.

The price of Squeeth is a good predictor of how much ETH will deviate from its average. This implies that the price of Sqeeth is an effective predictor for how much ETH exposes us to risk.

Conclusion

Squeeth appears to have a good handle on the volatility of ETH, based on our investigation. We discovered a polynomial relationship between the price of Squeeth and the realized volatility in ETH prices up to the same point in time. In other words, Squeeth tracks the historical volatility of ETH well. Additionally, the price of Squeeth and the realized volatility in ETH prices are positively correlated. Finally, Squeeth is also a good predictor for how much ETH’s price has deviated from its average.

This article suggests that Squeeth can be useful for predicting the volatility of ETH in the future. Squeeth is similar to the VIX (CBOE Volatility Index), which predicts the volatility of the S&P 500 index using option prices. However, Squeeth does not have an expiration date, while VIX relies on options with expiration dates in the near future. It is not clear if this makes Squeeth more reliable.

Squeeth can be used as an alternative to any USD/ETH option, as it provides exposure to pure convexity with no expiration dates or strike prices. However, it is important to note that traders who are long Squeeth have to pay a daily funding rate to make up for the constant exposure to decreased risk and increased reward.

Shelly Liu is a junior at Harvard College studying computer science. She is currently an intern at Google working in software engineering.

I want to give a special thank you to Zubin Koticha for his help and feedback while creating this piece.

This piece of research is not intended to be investment advice. Harvard Blockchain and the author are not financial advisors.

Leave a Reply